$BTR Tokenomics: Everything to Know

Bitlayer is embarking on its first step toward decentralization.

We are excited to announce the launch of the $BTR token. Built on Bitcoin’s native security architecture, Bitlayer is constructing a trust-minimized BitVM Bridge, a yield-bearing asset YBTC and a high-throughput Bitcoin Rollup — bringing true utility, speed, and composability to Bitcoin, and establishing a complete DeFi infrastructure for the Bitcoin ecosystem.

The $BTR is the governance token of the Bitlayer ecosystem, playing a critical role in governance, and incentives within the ecosystem. This post intends to help the bitlayer community understand how the tokens have been distributed at the launch of the upcoming TGE, and may be distributed thereafter.

About the $BTR Token Launch

- Token Name: Bitlayer($BTR)

- Total Token Supply: 1,000,000,000 $BTR

- Initial Circulating Supply: 261,600,000 (26.16%)

$BTR will be minted on Bitlayer Network, and distributed through Ethereum mainnet, and BNB Smart Chain, ensuring broad accessibility and cross-chain compatibility from day one.

$BTR Token Utility and Value

$BTR will be used as a primary governance mechanism of the protocol and progress to being a protocol utility token as Bitlayer becomes more decentralized.

Here are $BTR’s three utilities and values you need to know:

-

Staking and Node Voting: $BTR holders can stake their tokens to support the network’s security and participate in node voting for important decisions. This operates as a delegation mechanism, where nodes represent stakers by providing network security and validating transactions.

-

Governance: $BTR holders are central to on-chain governance, allowing them to shape the future of the ecosystem. Through governance voting, $BTR holders can decide on critical parameters and make significant decisions, such as protocol upgrades, fee adjustments, and other key aspects of Bitlayer’s evolution.

-

Fee Switch: The Fee Switch mechanism, which can be activated by the affirmative vote of sufficient $BTR holders, allows adjustment of how transaction fees are allocated. When the Fee Switch is activated, a portion of the protocol’s revenue will be directed towards distributing rewards to $BTR stakers or used for $BTR buybacks. This flexible mechanism ensures that the ecosystem can adapt and reward its participants while supporting the long-term sustainability and growth of the Bitlayer network.

Token Supply, Distribution and Vesting Details

We have thoughtfully designed our token distribution to maximize impact for our community and enlarge our global distribution of applications and services.

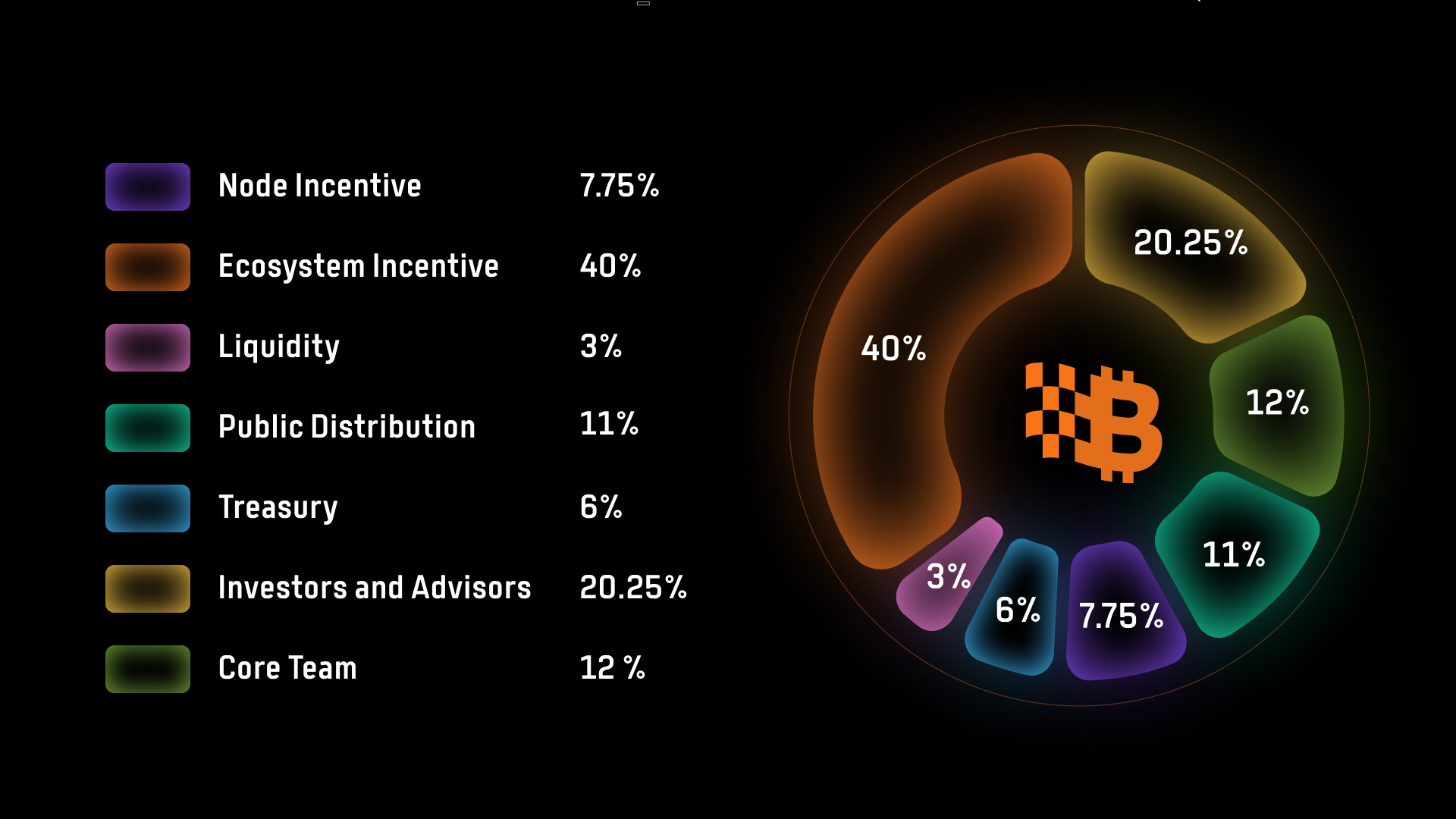

Below is a breakdown of the planned allocation of 1,000,000,000 $BTR tokens across various categories for a balanced distribution of incentives, ecosystem development, and governance. The allocation to the separate categories may be changed from time-to-time, and the names of the categories may change, provided that no additional allocation will be taken from other categories to be given to early team members, investors or advisors.

-

Node Incentive: 7.75%

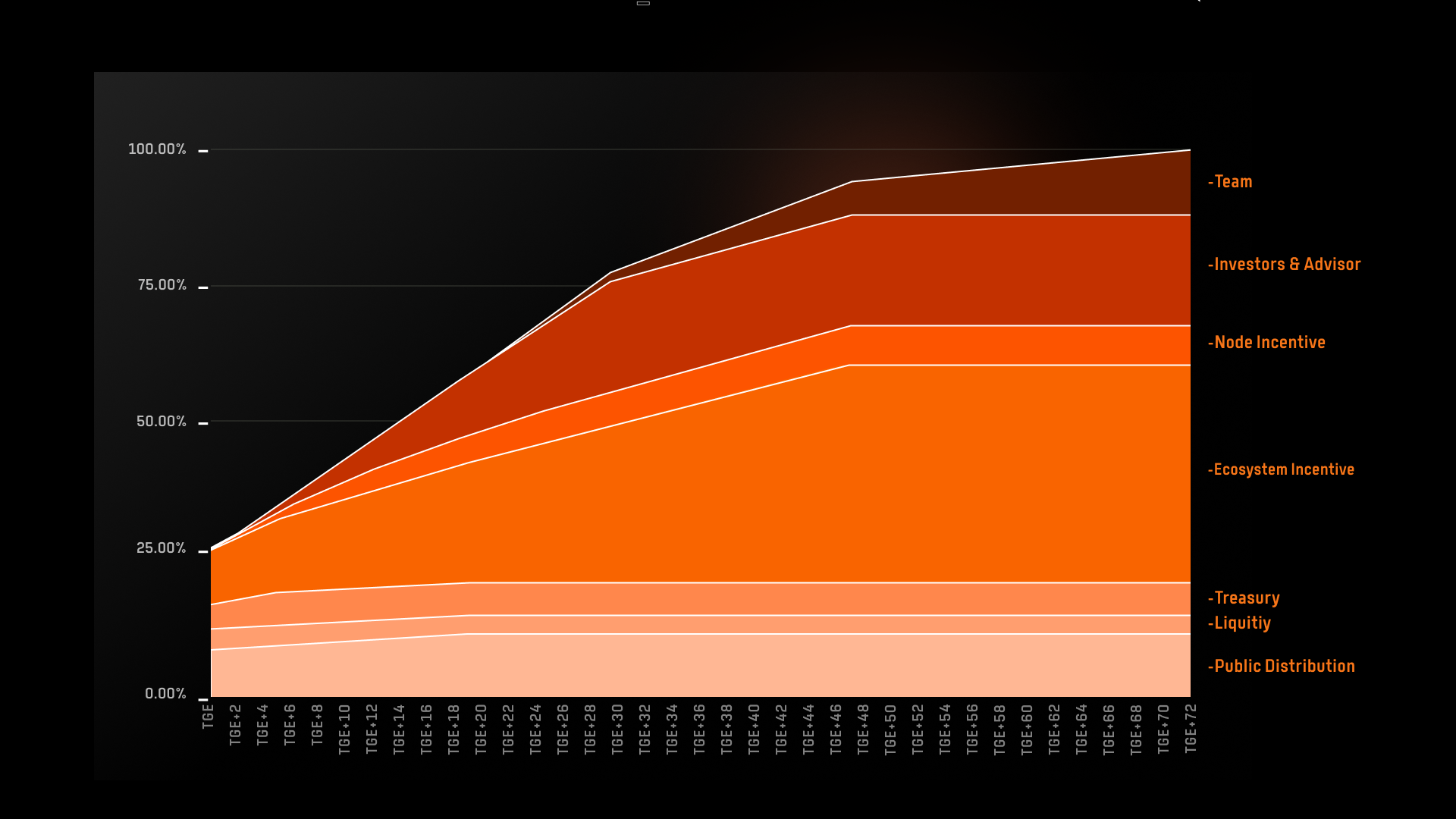

Node incentives are allocated 7.75% (77.5 million $BTR) to reward network operators. The unlock schedule begins with 3.875% of the total supply in the first year, followed by annual halving of the unlocked amount (e.g., ~1.9375% in year 2, ~0.96875% in year 3, and so on).

-

Ecosystem Incentive — 40%

Ecosystem incentives receive 40% (400 million $BTR) to foster growth through grants, bounties, investments, marketing, and acquisitions. 25% of these tokens are unlocked at TGE, and the remaining 75% vest linearly over 48 months, reaching full unlock at month 48.

-

Liquidity — 3%

Liquidity provision is supported with 3% (30 million $BTR), which is fully unlocked at TGE.

-

Public Distribution — 11%

Public distribution is allocated 11% (110 million $BTR). 79% of these tokens are unlocked at TGE. The remaining 21% undergo a 1-month cliff (no tokens released during this period) followed by 18 months of linear vesting, with full unlock at month 19.

-

Treasury — 6%

The treasury receives 6% (60 million $BTR). 75% of these tokens are unlocked at TGE, and the remaining 25% vest linearly over 5 months, reaching full unlock at month 5.

-

Investors and Advisors — 20.25%

Investors and advisors are allocated 20.25% (202.5 million $BTR). This portion has a 6-month cliff (no token release) and then vests linearly over 24 months. Full unlock is achieved at month 30.

-

Core Team — 12%

A total of 12% (120 million $BTR) is allocated to the core team and contributors. This allocation is subject to a 24-month cliff, followed by linear vesting over 48 months. Tokens are fully unlocked at month 72.

Stay Tuned for More Updates

With this post, the Bitlayer Foundation has created a transparent resource to inform the community about the distribution of $BTR tokens. Any emission of tokens in the future will serve the primary purpose of growing the value of the protocol for all stakeholders.

Keep in mind that our TGE is merely the foundation for a long-term journey ahead. We reward loyalty and commitment, and we will only get stronger with time. Please make sure your seats and table trays are in an upright position, fasten your seatbelts and enjoy the racing ride!

Stay connected with us through our official channels to receive the latest updates.

Disclaimer

This material is provided solely for general informational purposes and does not constitute or form part of any offer, invitation, or solicitation to purchase or sell any securities, financial instruments, digital assets, or any other investment products, nor shall it be relied upon in connection with any contract or commitment whatsoever. Nothing contained herein shall be construed as investment, legal, tax, or financial advice. You should not rely on any information presented as a substitute for your own independent judgment or the advice of professional advisors.

Participation in any digital asset-related activity involves significant risks, including but not limited to market volatility, loss of principal, technology failure, counterparty default, regulatory changes, and liquidity constraints. You may lose all or part of your digital assets, and past performance is not indicative of future results.

Bitlayer and its affiliates does not guarantee any returns or yield, and makes no warranties or representations, express or implied, regarding the accuracy, completeness, or reliability of any information presented. All product features, metrics, and forecasts are illustrative only and subject to change without notice. Users are solely responsible for ensuring that any use of or access to Bitlayer’s offerings is in compliance with applicable laws and regulations in their jurisdiction. Bitlayer and its affiliates expressly disclaim all liability for any direct, indirect, or consequential loss or damage arising from the use of or reliance on this material.

You should consult your own legal, tax, financial, or other professional advisors before engaging in any digital asset-related activities.

About Bitlayer

Bitlayer is pioneering the first BitVM implementation. By merging unparalleled security with a lightning-fast smart contract engine, Bitlayer unlocks the full potential of Bitcoin DeFi.

Built on Bitcoin’s native security architecture, Bitlayer is constructing a trust-minimized BitVM Bridge, a yield-bearing asset YBTC and a high-throughput Bitcoin Rollup — bringing true utility, speed, and composability to Bitcoin, and establishing a complete DeFi infrastructure for the Bitcoin ecosystem.